Essential Financial Strategies for Physicians in Their 30s

Congratulations are in order, and hopefully some meaningful celebrations are being planned and undertaken too! You’ve put in years of dedication, training, early mornings + late nights, and countless clinical hours, and now you're on the brink of launching your career as a physician. With your first attending job likely bringing in $250K or more, you’re stepping into a whole new world—not just professionally, but financially.

This transition is exciting, but it also comes with new responsibilities. How you handle your finances in these early years can set the trajectory for long-term financial success, stability, and impact. Here’s 10 personal finance tips for physicians in their 30s to help you understand the financial elements you'll want to master [or outsource] so you can make informed, strategic financial decisions as you enter this next phase and beyond.

#1: Cash Flow: The Most Important Indicator of Financial Success, Yet the Most Underappreciated

Making informed decisions with your personal finances, both now and until the end of time, always comes back to Cash-Flow. I'm not saying you have to obsess over every dollar you spend or eat peanut butter sandwiches until your student loans are paid off, but I am saying that bringing AWARENESS to your cash-flow is an absolute necessity that most households neglect. Most graduating physicians know they spend less than their new salary, but it has to go further than that.

Your cash-flow determines just about every single strategy in personal financial planning -- student loan repayment strategy, rent vs buy & home purchase affordability analysis, your savings strategy, your retirement tax-planning strategy, how much life and disability insurance you need, family planning - ALL OF IT! You simply cannot make informed decisions about your personal finances without a deep understanding of your Cash-Flow.

If you want to uncover how I help clients bring awareness to their cash-flow, and actually help them automate both their budgeting & savings (without the need for a budgeting app), watch this short, illustrative 5-minute YouTube video:

#2. Student Loans: A Strategic Approach to Repayment

For most new physicians, student loans are the elephant in the room. With $250k+ in student loans not being uncommon to start out with, it’s critical to develop a repayment strategy that aligns with your projected short-and-intermediate term income plus integrating your repayment strategy with your other life goals (starting a family, buying a home, starting your own practice, etc.).

As of the time of this writing, student loans are an absolute mess. The SAVE plan enacted by the Biden administration is being battled in the courts (likely to go away in my honest opinion) and thus is in forbearance, PAYE [which requires a partial financial hardship] and ICR have been recently reinstated until July 2027 for qualifying borrowers, the ParentPLUS double consolidation loophole is retiring in July 2025, and PSLF eligibility is a complete animal of its own to wrap your arms around.

During your first couple years as a new physician, there are some debt management strategies that can save you thousands of dollars in student loan payments while you're getting your financial foundation established. For married couples, navigating the tradeoff between lower student loan payments but higher taxes with Married Filing Separately ("MFS") vs potential higher student loan payments but lower taxes with Married Filing Jointly ("MFJ") is something to consider. Not to mention some income-tax strategies in the first 2 years for those on an Income-Driven Repayment Plan (SAVE, PAYE, ICR, & IBR) by intentionally extending your tax return to allow the Loan Servicer to use lower residency-income levels for your student loan payments (even though you're actually making your now-several-hundreds-of-thousands-of-dollars salary).

#3. Buying a Home: Timing and Strategy

With a sizable salary increase, you may feel pressure to buy a home right away, but it’s worth stepping back to evaluate the bigger picture, and how your residence fits in with your broader financial picture and goals.

Job Stability & Location: If you anticipate relocating within the next five years, renting more often than not tends to be the better option.

Physician/Dentist Loans: Certain banks offer these special mortgage programs that allow for lower down payment options (oftentimes 0% down on loan amounts under $1M) without requiring private mortgage insurance (PMI). Many new physicians don't have the money saved to put a sizeable down payment on a home, so it's worth looking at what the all-in cost of owning would be, accounting for the P&I (Principal and Interest), Property Taxes, Homeowner's Insurance, Closing Costs, home-furnishing needs, potential 1-time or ongoing repairs and maintenance, etc.

#4. Managing Big Ticket Celebrations and Lifestyle Creep - Responsibly

It's not uncommon after years of sacrificing and saying "No" to fun activities and trips your non-medical peers have gone on, to want to be able to make up for the lost time and say "YES!" finally. And you probably should!

What I often tell clients is it's perfectly OK to indulge for a season, just don't make it your new permanent lifestyle. As hard as it likely was during residency to say "No" to fun trips, it's even harder once you graduate because now you have the OPTION to say Yes. Before, you just couldn't swing it financially, whereas now you probably could, but that doesn't mean you ALWAYS should. It takes discipline and self-control and balance.

Lifestyle creep is real; it happens to most of us. But when lifestyle creep becomes unchecked, it can actually contribute to financial obligation and "slavery" rather than flexibility and freedom. Getting a huge mortgage, fancy cars, the latest technology, and wanting to start a family while paying back your student loans will make your new big salary required just to meet your fixed expenses every month, not to mention wanting to have some fun too (eating out, travel, hobbies, etc.) while building your financial foundation and stability.

#5. Tax Strategy: Minimizing Lifetime Tax Burden

With a high-income career ahead, tax efficiency should be a priority from day one. But as I mentioned earlier, your tax-accumulation strategy (fancy term for how you most effectively and efficiently build UP your assets so you minimize your LIFETIME taxes paid), it should be dictated by your cash-flow (both your income AND expenses).

As a CPA, I love talking about HSA's and Backdoor Roth IRA Conversions and Mega-Backdoor 401k contributions and 457b's and 529's and Brokerage Accounts and Tax-Efficient investing, but it's all a moot point if you as an individual or me as a Financial Planner don't have our arms around your savings capacity, projected retirement timeline, behavioral financial tendences, etc.

#6. Balancing Investing for Retirement and Debt-Paydown

Investing can be a lot of fun. The idea of contributing your dollars towards companies and causes that are moving the world forward and you multiply your investment in the process is fantastic. But just like any skill or trade worth doing in life, we have to build a foundation first. I'm sure you would have loved to start helping individuals with their medical needs on day 1 of school - but you had to put in the necessary work doing non-glamorous activities to start, so that you can set yourself up for the glamorous activities in the future. Finances are no different.

We have to build liquidity first and foremost before we start aggressively paying down debt, or investing for retirement, or even starting your own practice. While it will depend on your specific circumstances, 6-months of your expenses earmarked in money market funds or low-volatility interest-paying assets is how you ensure you're building your financial foundation on the Rock, and not the Sand. Life will inevitably throw curveballs at you - it's only a matter of time. A medical expense, job loss, home repair, car troubles - it's not a matter of If, it's a matter of When, and you have to be prepared if you want to navigate the turbulent waters successfully.

Once you DO hit that point where you're ready to pay down debt and/or invest for retirement, there's a lot of different vehicles to do so. While every situation is unique (after all, it's called PERSONAL finance), I tend to opt towards starting with a 401k/403b match, maxing an HSA (assuming you have access to a High-Deductible Health Plan and you're healthy), maxing a Roth IRA or Backdoor Roth IRA, going back and maxing out the Employee portion of the 401k/403b ($23,500 in 2025), focus on some modest brokerage account savings, then if there's still room, opt for the Mega-Backdoor Roth 401k/403b and then 457b [assuming they are available at your company]. If you have kids and value saving for their education, a 529 or UTMA also enters the discussion as well.

#7. Life and Disability Insurance

Physicians (especially recent grads) are a huge target for insurance salesman who typically push permanent life insurance products like Whole Life Insurance or various versions of Universal Life Insurance. As the adage goes "Most insurance products are sold, not bought". I've found this trend to very true in my experience with clients, peers, and friends. While there CAN be a place for permanent life insurance in areas such as advanced estate planning, I have a huge problem with the way many permanent life insurance policies are sold, how they are marketed (often falsely and in misleading fashions), who they are sold by and how those insurance salesman are paid, and the [lack thereof] of legal/regulatory standards to which they are held to when selling these products to consumers.

With that said, while True Riches does not sell insurance (or any kind of commission-based product for that matter), we tend to prefer Term policies. When thinking about life and disability insurance, it's important to ask the seemingly obvious question "Do I need this?" before starting the process. While it is true that the younger and healthier you are, the better health underwriting class you'll get and therefore the cheaper premiums you'll get. But if you don't need the coverage, then you probably don't need to pay for coverage you don't need! With that said though, I do often see those who should probably have life insurance (those with financial dependents and not enough assets or surviving-spouse income to self-insure the risk of passing away) that do NOT have it, and that's worrisome too.

When it comes to quantifying "How much insurance do I need?", it comes again back to....you guessed it -- Cash Flow! Contrary to how Life and Disability Insurance are typically marketed, they are not a replacement for your income per se, but rather, a replacement for how you cover your expenses! Are you starting to pick up on the absolute necessity of knowing what you spend yet? ;)

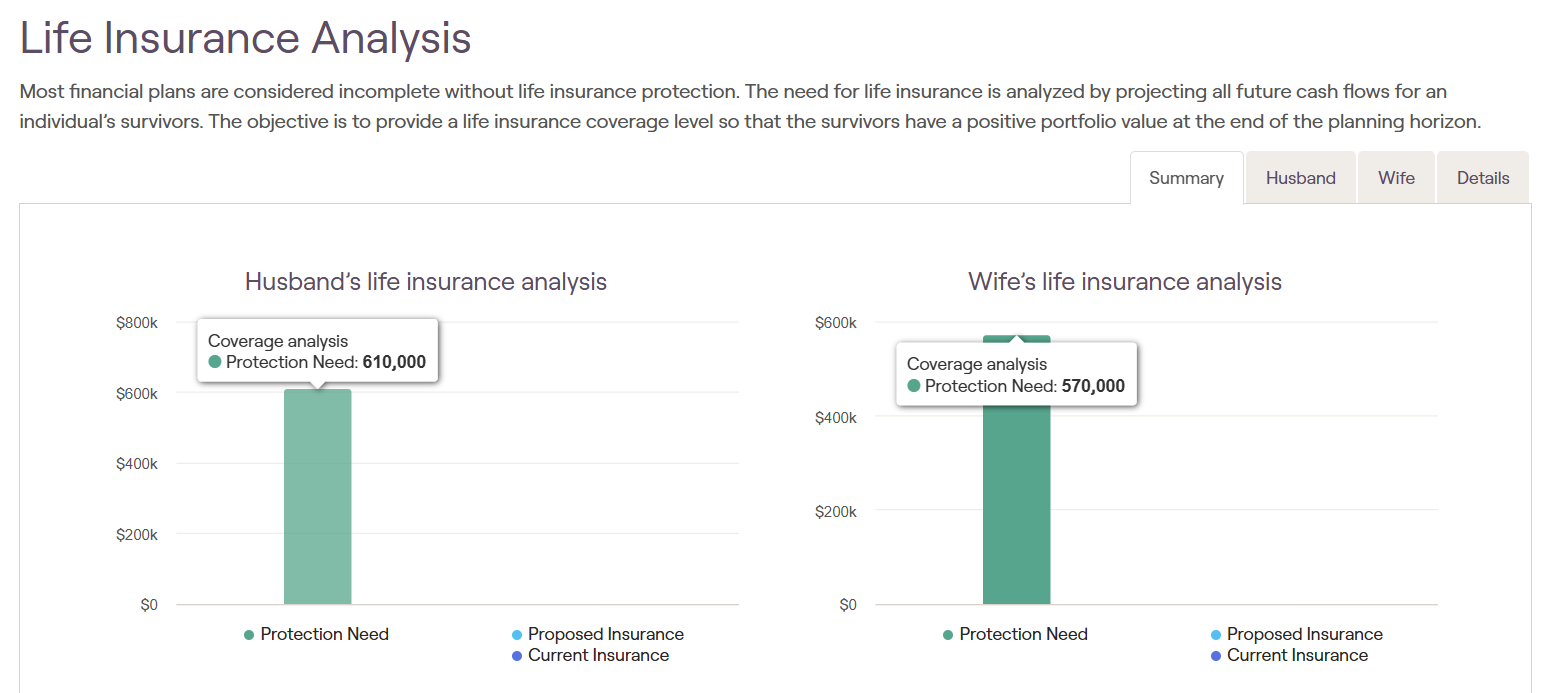

As part of my services for financial planning clients, I will help them quantify how much Life Insurance they need, based on their actual expenses, debt, and assets, so we can feel confident about securing the necessary amount of coverage, without going overboard and paying too much in premiums, or having a potential gap that isn't covered. My financial planning software, Right Capital, helps with this by calculating a "Protection Need" - in other words, how much money would need to come in to the portfolio when considering the surviving spouse's needs [and income], kids needs, non-cancelable debt, all of it. You can see a snippet of a Sample Husband + Wife Client below.

Quantifying Life and Disability Insurance is admittedly, however, both Science and Art. Some couples prefer to have a bit more coverage to have an "emotional safety net", knowing that if anything were to unexpectedly happen, they'd have flexibility with things like their timeline returning to work, paying for funeral expenses, therapy for children, etc. Others maybe understand that they'd need to relocate to a cheaper home or neighborhood or maybe they have family that has the capability to jump in and help with their time and resources, so they don't feel they need to go crazy with their coverage amount as much. That's the Art part of it all, and are discussions we have before shopping coverage together with a trusted, independent insurance broker.

#8. Family Planning: What a Big Change It Is

Whether you already have kids or are thinking about having kids soon, it's a major change in life. Both financially and holistically. But from a financial perspective, there's several things to consider with Family Planning:

- For those with fertility struggles, there can be high financial barriers for Assisted Reproductive Technology ("ART") procedures such as IVF, ZIFT, ICSI, etc., of which only ~16 states have mandate-to-cover or mandate-to-offer laws for fertility treatments

- Life and Disability Insurance (discussed above) now that you will have a financial dependent

- Establishing an estate plan including Wills or a Trust, Financial and Medical Powers of Attorney, and Guardianship Elections, so that the State you live in doesn't decide how your financial affairs are handled or who takes over as guardians of your children should something happen to you. It's important to remember to also appropriately update the Beneficiary Designations for each asset you own, taking into account the proper titling on the beneficiary designation, as minor's cannot directly own assets. As a bonus side note, True Riches all-in-one Quarterly Fee includes the cost to establish an estate plan and help updating beneficiary designations

- Child expenses such as hospital bills, daycare and/or reduced income from 1 parent staying home, future education expense planning, and just the cost of raising another human being!

- Having kids can have dramatic effects on your priorities life and also how much time + energy you have to devote to your Vocation. This is often the hardest point to understand before having kids, but it's very real

#9. Giving Back: Generosity as a Way of Life

Many physicians have a deep desire to give back, whether through community initiatives, pro bono work, or charitable donations. At True Riches, one of our core values is Generosity, and while we of course don't expect anybody to align exactly with what we believe, we've found one of the most compelling data points around alignment is those with a heart for consistent generosity.

As a physician who's income jumped dramatically overnight, the truth is: if you don't start giving now, it's extremely unlikely you'll ever start. There's ALWAYS a "I'll give once [insert something in the future happens]." Some examples might be: "I'll start being generous once I get a years worth of savings" or "I'll start being generous once I pay off my student loans" or "I'll start being generous once I max out my retirement accounts each year" And the cycle continues on and on. As Jesus said in Luke 16:10-11: "Whoever can be trusted with very little can also be trusted with much, and whoever is dishonest with very little will also be dishonest with much. So if you have not been trustworthy in handling worldly wealth, who will trust you with true riches?"

Giving [and money] are arguably more about a heart-posture than anything else. But once you've decided in your heart and are committed to a life of consistent generosity, now the question becomes "How do I make the most impact with my generosity?"

While there are several strategies we leverage to compound the financial effects of our clients' generosity, we've found that establishing core "pillars" (or "lanes") is essential to developing your philanthropic "mission statement" and from there leveraging tax-efficient methods such as a Donor-Advised Fund ("DAF") to save the most on lifetime taxes along the way.

#10. Building the Right Habits Now Will Multiply Tenfold Over Your Life

Like anything health related, taking the proper preventative measures and building the right habits from the get-go is an absolute game-changer when it comes to managing and building your long-term health. Reactive medicine can be really challenging, and it's no different in personal finance. While I LOVE helping people implement excellent financial habits, systems, and strategies, it hurts my heart when I hear clients say "I wish I would have done this 10 years ago". Undoing potentially toxic or even destructive financial habits often entails headache, heartache, and sometimes regret they didn't take action sooner. For a more light-hearted way to explain this, check out this short 41 second YouTube Video:

Final Thoughts: My Friend TED

When it comes to deciding whether to DIY or Outsource a professional service, I encourage people to ask themselves "How good of friends am I, or do I want to be, with TED?"

TED is:

Time

Energy & Expertise

Desire

If you look back at the above 10 points, do you have the Time, Energy, Expertise, and Desire to carry them out excellently, strategically, and accountably? If so, you are a great candidate to DIY!

And if not, you could be a great candidate to consider partnering with an independent, fiduciary-at-all-times, fee-only CPA and CERTIFIED FINANCIAL PLANNERTM who specializes in helping Christian physicians in their 30's and 40's. Our services bundle cash-flow systemization and automation, student loan repayment strategies, tax planning (and we will file your taxes for you too!), investment strategies (when it becomes relevant), company benefits optimization, charitable giving strategies, estate planning (including the cost to get an estate plan and put it into place!), insurance planning, retirement planning, and more - all for ONE TRANSPARENT FLAT-FEE.

You’ve worked incredibly hard to get to this point, and now is the time to be intentional and strategic about your financial future. The decisions you make in the next few years will have a lasting impact on your ability to build wealth, achieve financial freedom, and make a meaningful difference in the world.

If you want a trusted guide in this journey, we’re here to help. Book a complimentary 60-minute Discovery Meeting to collaborate on your financial puzzle pieces and if we'd be able to add value in excess of our fee for your specific financial situation.