It was the Fall of 2017. Another routine day at the gym. Except this time that Power Clean lift hurt my back. Like real bad. One thing leads to another, and I’ve got a herniated disk at L5-S1, and have battled ongoing chronic nerve pain since that time.

While I’m still in the fight in some form daily, I’ve had seasons where its gotten a lot better, and seasons where I feel like I’m at square negative 7. These ebbs and flows have allowed me to see things from multiple perspectives, and more recently, I took the time to reflect on the analogies of my battle with chronic nerve pain to personal finances. May one (or more) speak to you.

1) Impressing Others is Overrated

One of the main reasons I started weight-lifting in the first place is I was tired of being thought of as the nice, skinny kid. I still remember 1 yearbook signature vividly: “Zack, you were the funniest and scrawniest kid in our whole class!” While this may seem childish (and it is), it had a lasting impression on me. I committed to do everything in my power to change myself, BECAUSE of how I wanted to be seen by others.

This led me to doing things I probably wasn’t ready for in the gym. And eventually it caught up to me and led to a feedback loop of injuries and chronic pain that has rocked my entire life since. The same is true with personal finances – we want to be seen as a certain type of person by others we admire, so we seek out sophisticated, complex, sexy strategies that seem to be working for others on social media, hoping it will result in being liked, valued, and accepted by others.

But the problem is, many of us don’t have the financial foundation established to be able to successfully navigate those illiquid, complex, or seemingly-sexy investment strategies. Investing like billionaires do is like trying to put on a leotard and mirror Simone Biles gymnastics routine. If you haven’t built up the necessary foundation of flexibility, strength, and technique, I guarantee you’ll seriously injure yourself and set yourself further back than you were before.

Humble yourself, know yourself, and let’s quit making financial decisions centered around what others will think of us; it’s grossly overrated. After all, comparison is the thief of joy.

2) Accepting you Can’t Control Everything is Ironically Freeing

In my battle with chronic nerve pain, I’ve done loads of physical therapy, acupuncture, massage, cupping, dry-needling, traction, chiropractic, controlled mobility and strength training, surgery, Pain Reprocessing Therapy, and counseling.

Do you have a hard time with letting go of control? Me too. During my ongoing counseling, we identified I was holding onto burdens and outcomes that if I truly swallow my pride and humble myself, aren’t necessarily within my control. The diagram my counselor showed me looks like this (although not my favorite color scheme):

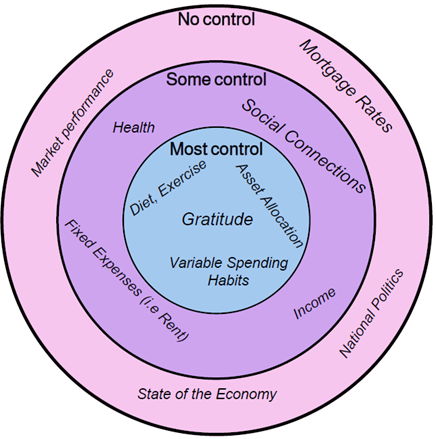

We can’t control outcomes, only inputs towards those outcomes. With my nerve pain, I wrote “I can’t control how my nerve pain is in this moment. All I can do today is do what will give me the best chance at making it a little bit better tomorrow.” I strongly believe that same concept can be applied towards our financial well-being.

Identifying what we can’t control and then letting go of those things is ironically freeing. As it pertains to personal finances, a synopsis Circle of Control could look something like:

3) Don’t Mistake Good General Financial Education for Personalized Advice

In the days of free information everywhere, it can be challenging at times to justify paying hard-earned dollars for a service. There have been times since 2017 with my nerve pain where I’ve thought “I should be progressing faster than I am in light of how many specialists I’m seeing and how much time I’m devoting to seeing them”. So I looked to free information from health influencers on Instagram. And I ended up hurting myself worse.

It's not that the information they were putting out was bad or even wrong, it’s that I mistook good general education for personalized advice. They don’t know me, my exact circumstances, my ‘pre-existing’ conditions, my history, my tendencies, and couldn’t provide me with coaching or feedback about my form, duration, or frequency.

How many of us are mistaking the good, general financial education from Tik Tok influencers or Dave Ramsey as personalized, professional, fiduciary financial advice? Do they know your exact financial situation? Your family of origin and values surrounding money? Do they know how to integrate balancing saving, spending, giving, investing, education funding, debt payoff, cash-flow management, and taxes into ONE cohesive PLAN? My guess would be very likely not.

4) The Value of an Integrated Team is Underrated

I’ve seen some amazing specialists in my journey with chronic nerve pain. But my biggest frustration has been they don’t collaborate with each other about my needs are, what the diagnosis from my latest appointment was, etc. I am playing the middle-man trying to communicate complex inner-workings of the human body to each specialist; there’s no integration or team-based approach to my recovery.

Similarly, there are a lot of great specialists out there in the financial planning world. But the REAL VALUE is having somebody who coordinates the team, collaborates with the teammates, and can bring everything together into 1 cohesive Plan.

Many people are playing Chief Decision Officer and Chief Coordination Officer on their own with nobody to help them navigate it all, and that’s certainly a big load to carry when you’re juggling responsibilities of family, work, community, health, and the other 28 things on your plate.

5) Our Identity is in God alone

Having a plan is wise. Surrounding yourself with good counsel is wise. But our IDENTITY is in God alone. Mercy triumphs over judgment, and grace over performance. When we put our identity in outcomes driven by our performance, we’re bound to fail at some point. That doesn’t mean we shouldn’t pursue prudent decision-making, discipline, and planning; the two are not mutually exclusive. I believe God calls us to do our best with what He's given us and who He’s given us, and trust in Him for the rest.

I’m still battling chronic nerve pain in some form on a daily basis, despite feeling like I’ve done ‘the wise things’ for a long time. But I have to remind myself that my value is not tied to my health, my physical abilities, or anything else I do. What I do is important, and there’s a rich theology in partnering with God to advance His kingdom, but my core identity is in Christ alone.

Similarly, too many of us are tying our worth to our net worth. There’s an easy-to-believe narrative living in westernized individualistic culture that your value is connected to what you earn. Don’t get me wrong, I am a strong advocate for excellent, competent financial planning, maximizing we have, etc., but worldly wealth is not a measure of our core identity. So continue doing good things with your finances; give generously, grow your net worth, maximize what you have – but at the end of it all, remember first and foremost that your identity is in God alone.

In my role at True Riches, I help busy Christian professionals and families in their 30’s & 40’s simplify their finances, develop a cohesive plan, and provide ongoing personalized advice in their best interest so they can maximize their life’s impact and experience greater purpose, peace, and joy. If you are wanting to take the first step towards getting intentional with your finances in alignment with Biblical principles, we’d love to see how we could help you.