How to Automate Budgeting and Savings without a Budgeting App by Creating a Cash Flow Administration System

One of the most common challenges I hear is how to budget and optimize Cash Flow. In other words, how to make the most of your monthly paycheck(s) and expenses, and managing all the moving pieces of what comes in and out from various accounts and sources.

Cash flow administration is one of the most important factors when it comes to having a healthy financial life, both from an emotional and administrative perspective. Yet at the same time, it is one of the areas with the most non-adherence (i.e. subject does not follow professional's recommendations). A big reason for this is that humans are creatures of habit -- whether those are good habits or bad habits. Unfortunately, budgeting and cash flow administration is generally an area with long-ingrained habits, many of them coming with a lot of emotional attachment as well. So it makes sense that many people are resilient to change when it comes to their monthly cash flow administration!

I will not pretend there is only one successful way to budget and manage your monthly cash flow administration. With that said, I strongly believe in creating a system centered around Simplicity. There's a notion that complex equals better in our society, especially when it comes to our finances. I could not disagree more, both from a comprehensive financial planning perspective, and at a more granular level, from a cash flow administration perspective.

I've seen some pretty wonky cash flow administration systems, and the one thing they all have in common is they are TIME-CONSUMING! 6 bank accounts, 3 income sources all going to separate accounts, Venmo'ing spouses for half of the grocery and insurance bills, but only 25% of the Target charges because they bought 4 shirts and 2 pair of pants last month. It's confusing, arbitrary, complex, and accordingly, takes a ton of time!

Below are 5 key principles when it comes to budgeting successfully and optimizing your monthly cash flow administration.

1) Consolidate your number of accounts. Outside of accounts solely used for business (such as an LLC bank account for your rental property business), shoot to have only 1 or 2 bank accounts for personal use. Doesn't matter whether you are single or married either.

2a) Married folks: With limited exceptions, get Joint accounts and close your Individual accounts. You said "Until death do us part" right?

2b) Non-married folks -- keep your accounts and finances separate. Operate as an individual entity until you're ready to make the long-term commitment, as we want to create a cash flow administration system that is sustainable for the long haul.

3) Automate as much as possible. Use Auto-pay for your bills, schedule recurring transfers where warranted. Again, automation helps with our most valuable, finite resources: TIME and ENERGY. I don't know about you, but I enjoy most things more than I do paying bills and figuring out how much I need to Venmo my spouse for groceries and Target charges.

4a) Pay all personal expenses from one account. This is huge. Every single household, whether you have $10 thousand or $10 million to your name, needs to know what their average monthly spend is. Your expenses are the most important number when it comes to making informed financial decisions. The problem is, most households have so many accounts and transfers and complexity, that it would take them numerous hours to reconcile what their true average monthly spend was, so they never do it! With 1 account, you can just add up the total of the outflows for the year from that 1 account and divide by 12 and walla!

4b) Have all income sources go to a different account than your expenses are paid from. Here's why: If you are consistently transferring money in and out from multiple sources (i.e. Venmo, transferring money to savings, gifts to charity, paychecks, etc.) these will convolute what the true income (inflows) and expenses (outflows) were. In other words, our income and expense assumptions will be incorrect, and we'll have bad data integrity. By separating where our income comes in and our expenses come out, we can easily determine what incomes were and what expenses were by looking at the 2 individual accounts separately.

A question you might be thinking at this point is: How does the money get from the account that income goes over to the account where expenses are paid from? Stay tuned, I didn't forget about you :)

5) Simplicity. Create a system that is logical, easy-to-remember, and also sustainable. What happens when you have a kid and the woman in the relationship takes 3 months of unpaid leave at work? Is she still responsible for 50% of the groceries and insurance, and whatever portion was hers from Target? What happens when one spouse starts their Social Security income early at Age 62, but the other spouse is holding off until Age 70 to get a higher benefit? Should the spouse who is waiting still have to pick up 50% of the bills even though they might be doing something that is advantageous to their holistic financial plan?

A Practical Method to Save Time Budgeting and Automate Savings without a Budgeting App

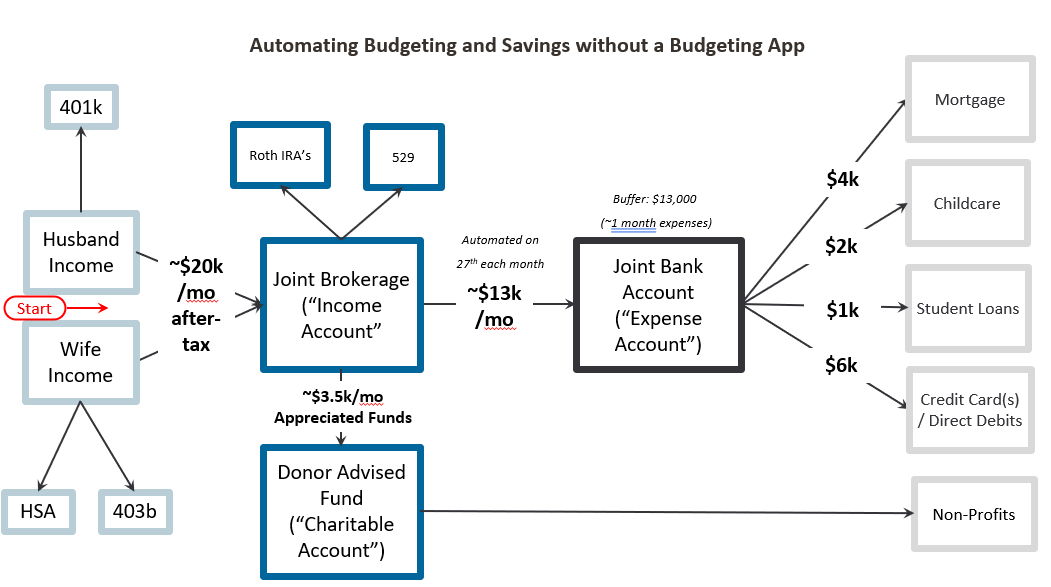

Below is a visual illustration of a proven and effective way that I utilize with clients to administer their monthly cash flow, which incorporates each of the 5 principles listed above. Note that the dollar values/numbers used in the illustration are for example purposes only, and are not intended to be guidelines. Additionally, while the below is illustrated for a married couple, the same philosophy can be applied to an individual.

For an interactive walk-through of the visual illustration, see the embedded YouTube video below the illustration.

For written commentary regarding the steps and elements of the visual illustration, see below the illustration and YouTube video.

Interactive Video Walk-Through:

Written Commentary:

(1) A husband and wife collectively earn $350,000 in household pre-tax income. After taxes, employer-sponsored health insurance premiums, HSA contributions, and 401k + 403b contributions, their average take-home pay is $20,000 per month. By simply changing their Direct Deposit instructions with their respective employer, the $20,000 is deposited into their Joint Brokerage Account (an investment account) each month.

(2) This couple sets up an automated monthly transfer on the 27th of each month from their Joint Brokerage Account to their Bank Account ("the expense account") in the amount of $13,000. $13,000 is their estimated average monthly expenses per month to meet their mortgage, childcare, student loans, credit cards, Venmo, direct banking debits, etc.

Notice the Bank Account has a $13,000 starting account balance ("the buffer"). This is to eliminate any stress or worry about the timing of expenses as they occur throughout the month and removes any risk of overdraft throughout the month. When the automated $13,000 from the Joint Brokerage Account hits the Bank Account, the Bank Account will have $26,000 ($13,000 Buffer + $13,000 Transferred Over).

(3) Throughout the month, your mortgage, credit cards, student loans, and other bills will be auto-paid from your Bank Account. Notice that through this point in the process, 100% is automated. Paychecks automatically come in, the recurring $13,000 monthly transfer happens automatically, and all your expenses are paid automatically. The beauty of this system is that your time is not spent on menial aspects of moving money around manually, making sure you correctly added up all the grocery/Target charges, and after all that still not being able to quickly and easily know what your true expenses are. Rather, your sole focus with this proposed system becomes reviewing your accounts to make sure the account balances seem reasonable and conduct a quick scan of your credit card charges to make sure nothing looks fraudulent.

(4) This couple gives 15% of their take-home pay to their local church and other non-profits doing work they deeply care about. Rather than giving cash from their bank account, this couple gives appreciated funds tax-free to charity through the intermediary use of a Donor Advised Fund ("Charitable Account"). The mechanics of this are beyond the scope of this post, but in essence, are giving $3,500 per month to charity. This step could be automated, or can be done manually for the purpose of promoting intentional giving and letting your heart be filled with Joy as you support causes you are passionate about.

(5) Because your $20,000 monthly take-home pay is being directly deposited into your investment account, savings accumulate automatically with no need for additional transfers. $20,000 gets deposited, and $16,500 goes out ($13,000 for expenses + $3,500 for giving), meaning $3,500 organically builds up in the investment account ($20,000 minus $16,500). This can then be invested in the brokerage account or saved into other tax-advantaged accounts such as a Roth IRA or 529 (depending on the couple's goals). Funding a Roth IRA, 529, or even giving to charity out of your Investment Account is important because these are NOT true expenses; they are transfers to other types of investments! Through this system, only true Expenses are paid from the Bank Account, thereby allowing for this couple to easily compute their true expenses on a monthly or annual basis without hectic noise from transfers for savings, giving, education funding, etc.

Now, let's say your average monthly expenses turn out to be higher than $13,000 per month after paying all your credit cards, bills, mortgage, student loans, etc. Not a problem! You can quickly identify this as the Bank Account buffer balance will be lower than $13,000 at the start of the month. Recall, the Bank Account starts with a $13,000 buffer, and then you transfer in an additional $13,000 for that month's expenses (bringing the total up to $26,000). If you spent $14,000 in a month as an example, your starting Bank Account balance would be $12,000 the following month ($26,000 less $14,000). Now, nobody's expenses are exactly $13,000 every month, which is why you have the $13,000 starting buffer in your Bank Account. If you notice that the Bank Account balance continues to decline month over month, it is an indication that your true expenses are indeed greater than $13,000 per month and you need to backfill your Bank Account from your Joint Brokerage Account (to get back to the $13,000 starting buffer), and increase the recurring expense transfer from $13,000 to whatever your average monthly spend has been.

At the end of the day, you have to know what your average monthly expenses are over extended time periods (such as the last 1 year). It doesn't matter if you make very little and have $10,000 to your name, or if you have ample cash flow and you have $10 million dollars to your name. You cannot make informed financial decisions without knowing what your average personal expenses are, YOU JUST CAN'T!

That's the beauty yet again of this system; it allows you to easily check what your total expenses by month are. All you have to do is simply look at how much money has left your Bank Account, as now 100% of your true personal expenses (giving and savings are not personal expenses) are coming from ONE account, with no other noise going on in that account!

Other Key Points Regarding Monthly Budgeting and Cash Flow Administration:

1) Emergency Fund:

I am an advocate for 3-12 months worth of expected personal expenses to be held in less-volatile, liquid* assets that can be easily accessed within 1-2 business days. And ideally, the bulk of the emergency fund is in an account that's separate from your regular Bank Account where you pay expenses from, and pays you prevailing interest rates (so NOT a traditional savings account, which are effectively useless if interest rates are above 0%). If we assume a 6-month emergency fund, in our example above, we'd have 1 month of our Emergency Fund ($13,000) in the Bank Account (the "buffer amount" we established), and the residual 5-months ($65,000 -- the bulk of it) would be held in the Joint Brokerage account. This way, you can easily leverage low-risk investment vehicles such as money-market funds, ultra-short term bonds, US Treasury Bills, etc. that carry minimal risk, yet help diminish the effects of inflation on your emergency fund. If inflation averages 2.4% for the next 30 years, your emergency fund would be cut in half after those 30 years if it was kept 100% in pure cash or a traditional savings account.

*I am generally not a fan of bank-issued CD's for an emergency fund given the liquidity restraints. The job of an emergency fund is to provide a stable source of quickly available cash when you need it most; a bank-issued CD does not accomplish this objective.

2) Saving for Specific Goals:

I generally do not prefer creating separate accounts for each different savings goal you have (such as a car, down payment on a home, international vacation, etc.). The primary reason: That swear word again called Complexity. The more accounts you have, the more there is to keep track of and accordingly, more time spent on menial tasks administering your finances. I would consider saving within your Joint Brokerage Account and selecting an appropriate investment fund/ticker for each goal -- depending on both the time horizon until the purchase and the dollar amount of the purchase. You can easily track which fund/ticker is attributed to each savings goal on the Notes tab of your phone, a Google Sheet, or whatever works best for you. That way, all your savings are still within 1 account, but you can easily track your progress towards each individual goal and are getting paid market rates of interest at the same time (you will even hit your savings goal faster)!

Take the Next Step

In my financial planning practice, I use this exact system with clients. But because I am the advisor on their Brokerage Account(s), Retirement Accounts (such as the Roth IRA's), Donor Advised Fund, etc. - I do all the heavy lifting of getting this system setup, investing cash buildup in the brokerage account, handling Roth IRA and 529 contributions, strategically using appreciated funds to use for charitable giving, and because clients link their bank account balance to my financial planning software, RightCapital, I monitor the bank account balance and can handle updating the monthly transfer amount, sending 1-time transfers as needed, etc. so that you can focus on excelling at your other life priorities, and delegate as much of the decision-making about tax-accumulation strategy, investing, and administrative work as you desire.

If you’re ready to take the first step towards controlling your monthly cash flow (and with greater simplicity and clarity), I’d love to help you explore how to make it a reality. By going through our complimentary 2-meeting process, you'll uncover how we'd tailor these principles to your unique financial situation and how to create a customized system that will save time, reduce stress, and promote smarter financial decisions over time. Take the first step by booking a complimentary 60-minute discovery meeting!