Types of Annuities & What Type of Annuity this Post Will Focus On

As you approach retirement, you are likely thinking about ways to recreate the paycheck you currently have so you can continue living your lifestyle (or a different version of it) in your retirement years. Many pre-retirees or retirees pivot towards annuities of many different flavors - some intertwining annuity products with investment products (such as a Variable Annuity or Fixed Annuity or Deferred Annuity) and some simply as an income-play by exchanging a lump-sum of money today for a guaranteed amount of income (a Single-Premium Immediate Annuity, or "SPIA").

Today's post will focus on the Pros and Cons of a simple SPIA -- using today's dollars to purchase an annuity contract that will provide you with a fixed amount of income over your life in retirement -- versus a diversified stock & bond portfolio ("Total Return Strategy"). I may write about the horror stories and typical gross inefficiencies of accumulation-based annuities (i.e. blending commission-riddled Annuity Products with Investment Products and the conflicts of interest that are present) on a future post, but for now, I'd prefer to steer clear of those (and hope you do too absent rare circumstances that could warrant one).

IMPORTANT NOTE: Today's post is NOT a comprehensive view of SPIA's for the masses - it is targeted at households who have the affluence, financial means and/or would benefit from working with an ongoing comprehensive financial planner to optimize retirement withdrawals, minimize lifetime taxes, curated portfolio construction, legacy planning, estate planning, Social Security filing strategy, and so on.

Mechanics of a Single-Premium Immediate Annuity ("SPIA")

At the most basic level, a SPIA involves you paying an annuity company a lump-sum of money today in exchange for a guaranteed, fixed amount of income for the rest of your Life (or the latter of you and your spouse's life if you elect a Joint-Life SPIA).

You can purchase a SPIA with non-qualified assets (i.e. a brokerage account) or qualified-assets (i.e. an IRA), with each having their own tax consequences and considerations.

The Pros of a Single-Premium Immediate Annuity ("SPIA")

1. Hedges Longevity Risk

Without a doubt, the main positive role a SPIA plays in a retirement portfolio is better hedging Longevity Risk as compared to a traditional Bond portfolio. Why is this? Mortality Credits.

Recall that annuities are various investors pooling their individual purchases of individual SPIA contracts together, and those investors who pass away early are effectively subsidizing the investors who live longer. Because SPIA's have enough investors, the annuity company actuaries can use mortality statistical probabilities with a great degree of confidence because they can rely on the law of large numbers for the SPIA's pool of investors to follow a traditional Bell curve on mortality timing.

2. Risk Aversion and Peace of Mind

For a retiree who is drawing down their investment portfolio in retirement, a new form of risk emerges: Sequence of Return Risk. Without a paycheck to cover your lifestyle expenses, a portfolio that is being withdrawn from while experiencing significant downward price movements can have devastating, lasting effects on a portfolio's preservation abilities. This is why diversification among and within uncorrelated types of investments (not to mention dynamic withdrawal strategies) becomes so paramount during the drawdown retirement years, because our ability to task on risk ("risk capacity") is diminished given the time horizon is shorter (assuming the retiree at hand doesn't want to have to make drastic cuts to their lifestyle during down-market years).

I give Point #2 here only half a point however because with proper portfolio construction and prudent ongoing portfolio management, this should be either a lesser or non-issue for most investors. But, if you do not have appropriate time horizons in place for each type of investment you own (and in which types of investment accounts), SPIA's can help provide comfort, stability, and peace of mind during turbulent times in financial markets, knowing a portion of your lifestyle expense is guaranteed via the fixed income payments from the annuity company to your bank account.

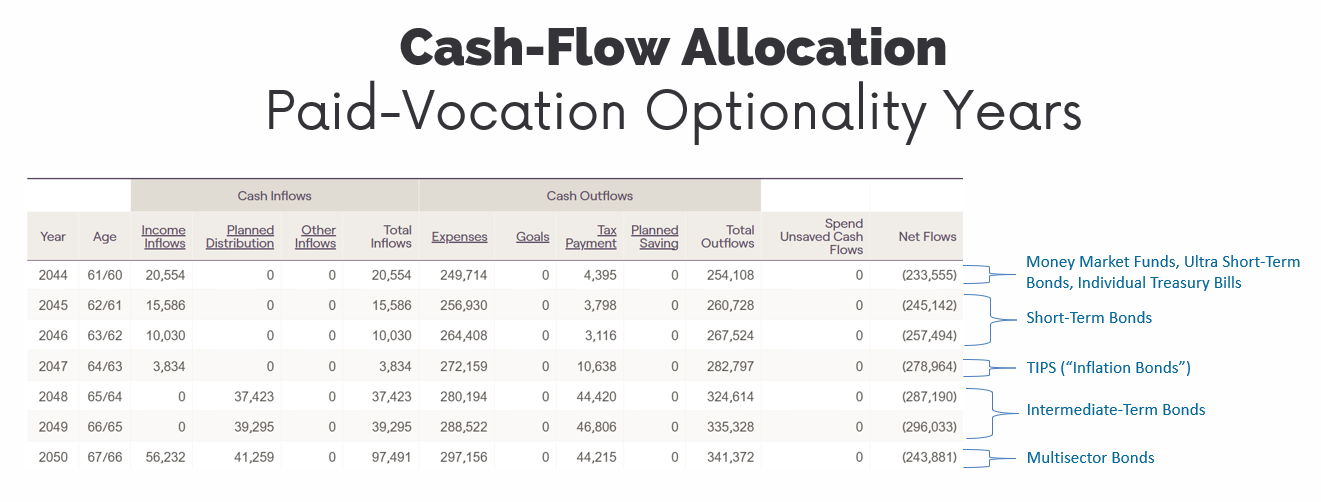

At True Riches, we build a completely customized asset allocation (mix of various types of investments) for every single ongoing client. This entails looking first at risk capacity (your ability to take on risk), as defined by the timing and amount of cash withdrawals from your investment portfolio. In simplest terms, we aggregate every aspect of your financial picture (income, expenses, assets, & liabilities) collaboratively into our financial planning software, RightCapital, and then ensure we have appropriate time horizons for each type of asset we invest in, as defined by your specific household's cash flows (inflows such as Social Security, portfolio income, part-time wages, pension, etc. minus outflows such as lifestyle expenses, debt payments, taxes, charitable giving, etc.). It looks something like this:

Going through this process on a collaborative and ongoing basis provides confidence we are taking on an appropriate amount of risk (and accordingly, working to achieve the required return to provide for your needs both short-and-long term), plus optimizing the balance between shortfall risk (being too conservative and thus not growing assets enough to preserve the spending power of the portfolio) with market risk (taking on too much risk and being subject to selling growth assets during market declines at inopportune times).

The Opportunity Costs, or Cons of a Single-Premium Immediate Annuity ("SPIA")

Much of the art & science of financial planning is optimization. We often have several options, none of which are "bad" options - but the pros of 1 option often heavily outweigh the others. Again, the below compares some potential opportunity costs of a SPIA for those working with a comprehensive financial planner, part of who's role is to appropriately construct a portfolio customized to the pre-retiree or retiree client through the lens of their lifestyle goals, time horizon, and tax profile. With that in mind...

1. Shortfall Risk

When it comes to finances and investment portfolios specifically, most people tend to think of taking on too much risk ("market risk") for what they can tolerate emotionally (risk tolerance) or prudently based on their time horizon (risk capacity). But there's another side to investment portfolio risk....Shortfall Risk!

Shortfall Risk is not taking enough risk to achieve the necessary rate of return to provide for your lifestyle goals over the duration of your life. And Shortfall Risk is just as real of a risk as Market Risk (taking on TOO much risk).

SPIA's provide a risk-free income stream, and the reason they are risk-free is because over extended time periods they won't pay as much as a risk-bearing investment (How do you think the Annuity company makes money?!). So while the income-stream is guaranteed, there is potential for erosion of purchasing power (because typically the income-stream is FIXED for life, yet goods and services in the aggregate cost more over time (that's inflation at work!). In contrast, a diversified investment portfolio that balances safe-haven assets (such as short-term, ultra high quality US treasury bonds) with growth assets (such as global stocks or real estate) can potentially better combat the effects of inflation over extended time periods while still protecting for near-term cash needs.

2. Lack of Control with Tax Planning

A fixed income stream is just that - FIXED. There is no ability to change it once it is in place, which can diminish the ability to do strategic tax-planning during retirement (especially in the years before claiming Social Security benefits).

The positive tax effects of things like intentional Roth conversions, accelerated Traditional IRA withdrawals, or Capital Gain harvesting to fill up low tax-brackets can be minimized or negated when a set income stream is in the picture. Ultimately, a SPIA can take you (or your financial planner and tax adviser, if you have one) out of the Driver's Seat when it comes to Tax Planning, and your ability to be in control of pushing down or letting off the gas pedal is reduced.

SPIA's are also inflexible in the way they generate taxable income*, as all income is considered interest income - which is taxed at Ordinary Income Tax Rates. With a diversified portfolio, there is the ability to generate some cash-flow via long-term capital gains, which are taxed at lower, preferential rates. While subtle and contrary to popular media publications, income re-creation is not the goal - but rather CASH-FLOW re-creation. When the focus is on re-creating cash flow rather than taxable income, tax burdens are lower, and the portfolio's ability to last for longer becomes even stronger.

*Certain states do exclude annuity income from state income taxation, however

3. Lacks Liquidity

I expand upon this point conceptually in #5 below, but with a SPIA, you are irrevocably sacrificing a liquid source (meaning readily-available to be used for ANY OTHER PURPOSE) of your investment portfolio to purchase this lifetime fixed income stream. What this means is that those funds now cannot be used in any other capacity - some examples might include: A once-in-a-lifetime family vacation while you're still able to make long plane rides over the ocean, a down payment on a 2nd home, an immediate health concern that requires substantial funds to treat or long-term care event, home renovations, intentionally wanting to withdraw a higher amount from your portfolio in the early years of your retirement (the "Go-Go" years), depleting non-qualified assets and accelerating 15%+ taxable IRA withdrawals, and the list goes on and on.

4. Legacy Planning / Wealth Transfer

Non-practicing academics such as Wade Pfau like to write about potential lifetime income shortages (by highlighting concepts such as Sequence of Return Risk and Longevity Risk). And while academics such as him make sound points, I think it often gets taken too far, and other methods they've discussed to combat these issues (such as strategic access to cash) get discounted. Putting all your assets in current or future guaranteed income streams are great for lifetime planning, but they tend to neglect next-generation wealth transfer and legacy planning. Not to mention abysmal tax consequences upon wealth transfer to the next generation, as non-qualified annuities do not receive a step-up in cost basis like other assets such as a brokerage account or real estate do.

5. Lacking Flexibility - The Most Powerful Force in Financial Well-being

As I've spoken about in the past, I believe one of the most underappreciated elements of financial well-being is being able to live with "metaphorical call options" -- that is....the right, but NOT the obligation, to pivot by taking a needed action during a needed season.

If you look back on your life, how many rolling 10-year time periods could you look back and say: "I knew I'd be exactly where I am today 10 years ago". For me personally, that's never happened once (in fact, NOT EVEN CLOSE) - and if you're anything like me, I'd guess the same is true of your life.

Research has shown that we as human's struggle to anticipate what our future self will want when we get there. Sure, we love to dream about the future - but we make the mistake of putting who we are TODAY in our future self's life! We think we'll have the exact same character, same hobbies, same abilities, and same community - the only thing we alter in our minds is how much free-time and money we'll have in the future. I hope I've begun to open your eyes to the power of "metaphorical call options". In simpler terms, flexibility is grossly underrated, and that's something a SPIA can't deliver on.

Final Thoughts

As with all things personal finance, remember they are just that....PERSONAL! There is no one size fits all, and there's beauty in the fact that God granted us the ability to exercise free-will over the resources He's entrusted to each one of us.

It must be said too that it doesn't have to be an all-or-nothing approach when it comes to utilizing a SPIA or a liquid, diversified investment portfolio - it can be both. And while I've outlined the primary reasons the majority of clients I've worked with in the past have intentionally chosen a liquid & diversified investment portfolio, there can absolutely be merit in leveraging a SPIA for a portion of non-discretionary cash-flow needs in retirement as well. The rise of commission-free annuities has grown, and while we do not sell any sort of products at True Riches (to remain as conflict-of-interest-free as possible), we leverage independent, third-party subject matter experts for any clients that want to further explore integrating a SPIA into their broader retirement planning needs.

When it comes to prayerfully contemplating whether to DIY or Outsource your comprehensive retirement planning needs, I encourage people to ask themselves "How good of friends am I, or do I want to be, with TED?"

TED is:

Time

Energy & Expertise

Desire

As you think about navigating optimization of retirement withdrawals, minimizing lifetime taxes, constructing and monitoring a portfolio customized to your risk-capacity and risk-tolerance, legacy planning, estate planning, Social Security filing strategy, and so on, do you have the Time, Energy, Expertise, and Desire to carry them out excellently, strategically, and accountably? If so, you are a great candidate to DIY!

And if not, you could be a great candidate to consider partnering with an independent, fiduciary-at-all-times, fee-only CPA and CERTIFIED FINANCIAL PLANNERTM who specializes in helping Christian's proactively prepare for and navigate retirement. Our services bundle strategic retirement withdrawal strategies, tax planning (and we will file your taxes for you too!), portfolio construction and ongoing investment management, Medicare and Social Security benefits, charitable giving strategies, estate planning (including the cost to get an estate plan and put it into place!), insurance planning, legacy planning, and more - all for ONE TRANSPARENT FLAT-FEE.

You’ve worked incredibly hard to get to this point, and now is the time to be intentional and strategic about your financial future.

If you want to proactively prepare for and navigate retirement with peace, confidence, and renewed calling alongside a trusted guide on your journey, we’re here to help. Book a complimentary 60-minute Discovery Meeting to collaborate on your financial puzzle pieces and if we'd be able to add value in excess of our fee for your specific financial situation.