DISCLAIMER: This writing in its entirety is intended to serve solely as general financial education and not personalized advice. Before considering acting on anything in this post, first consult with your tax, legal or investment advisor.

The Role of International Stocks in a US Investors Portfolio

Investors in their 30's and 40's have known 1 thing since they started investing: US stocks just seem to outperform non-US stocks. And with minimal exceptions since 2009, that's mostly been true, with US stocks returning ~11% per year and foreign stocks returning ~3% per year. Of course, this run of strong outperformance since 2009 has not always held true, and we'll unpack some contributing factors to this strong era of US-stock dominance, along with the seldom-discussed role foreign stocks play in a US investors portfolio.

International Stocks Can Hedge USD Currency Risk

Investing in international stocks is not only a diversification play (as you are becoming a fractional business owner in thousands of additional companies you wouldn't otherwise be owners of in a U.S.-only stock portfolio), but arguable even more so international stocks are a currency diversification play. It's likely you as a US investor have the bulk or all of your assets, income, and expenses denominated in US Dollars ("USD"). And because of that, you are heavily exposed to the US dollar and thus carry a form of USD-currency risk.

This concentration towards USD currency presents an opportunity to diversify that risk across other currencies, which international stocks provide. Now, as some have [correctly] pointed out, with the spread of economic globalization, many U.S. headquartered companies like Apple, Microsoft, Coca-Cola, etc. derive a portion of their revenues from foreign countries, thus providing a partial USD currency hedge. And while this is true, it's not as effective of a hedge as owning international stocks. Why? Because a U.S.-based company has to convert all those foreign-earned revenues back to USD to pay all their business costs like employee wages, direct business expenses, overhead costs, taxes, dividends to shareholders, etc. Foreign based companies, on the other hand, do not have this requirement to convert all their revenues back to USD, thus subjecting themselves to a weakened US dollar and thus, reduced USD-adjusted profits and reduced real USD purchasing power.

Now, for the past ~15 years, the strength and performance of the US dollar relative to other foreign currencies is a large factor in what has created such outsized US-stock returns relative to USD-adjusted international stock returns. In other words, if the US Dollar strengthens relative to a foreign currency (much of what has occurred the past ~15 years), when the foreign currency is converted to US Dollars, it doesn't buy as many US Dollars, thus diluting the USD-adjusted returns derived from that foreign currency. And the opposite is true as well -- when the US dollar depreciates, foreign currency returns are now worth more, because they can be converted into more US Dollars, because the US dollar weakened against that foreign currency.

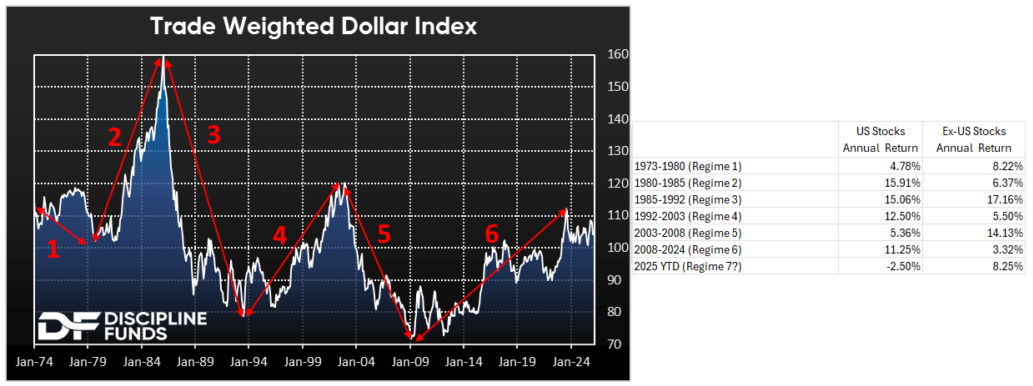

I like the 2 below charts to help illustrate this point, both long-term and short-term.

Chart #1: LONG-TERM

There is a correlation between a depreciating / (appreciating) US Dollar and underperformance / (outperformance) of US Stocks relative to International Stocks | Obtained from Discipline Funds

Notice in the very-right-hand column the annualized returns of US Stocks vs International Stocks over different time intervals spanning the last ~50 years. While there are of course a complex web of factors at play in the difference between US Stocks and International Stocks performance, it's easy to identify that during periods of the US Dollar weakness (i.e. being devalued), International Stocks have carried oftentimes significant periods of outperformance relative to US Stocks during those times, and vice versa.

I also like how this chart can inform readers in their 30s and 40s (or remind those who are 50+) that US Stocks have not always outperformed International Stocks. While recency bias from the last 15 years may lead us to conclude US stocks will continue outperforming indefinitely, mean-reversion in investing is very real across several different data points and factors.

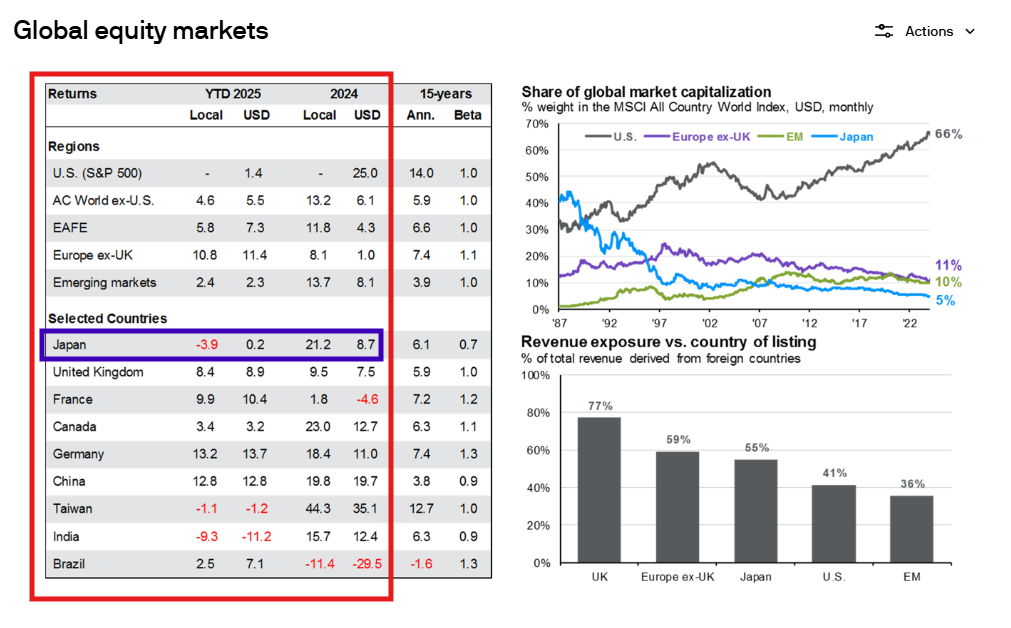

Chart #2: SHORT-TERM

Illustrative comparison of foreign countries annualized stock returns in both local currency and when converted to USD currency | Obtained from JP Morgan's Quarterly Guide to the Markets, Q1 2025 web edition

Notice the returns from Japan's stock market over 2024 and YTD 2025 (circled in blue). In 2024, the return in Local currency was 21.2%, but when converted to USD, the return was 'only' 8.7%! Contrast that with YTD 2025 where the return in Local currency has been -3.9%, but positive 0.2% when converted to USD.

Don't get me wrong - in the long-run, US Stocks have been a fantastic historic inflation hedge (as Inflation is one of the key risks to an investment portfolio over time) - but as the above charts show, US stocks can undergo periods of relative underperformance during periods when the US Dollar depreciates. That's the beauty of a globally diversified investment portfolio is its ability to hedge different types of risks (inflation risk, market risk, currency risk, etc.) across different time periods and different economic cycles.

Incorporating International Stocks Can Organically Smooth Sector Concentration Risk

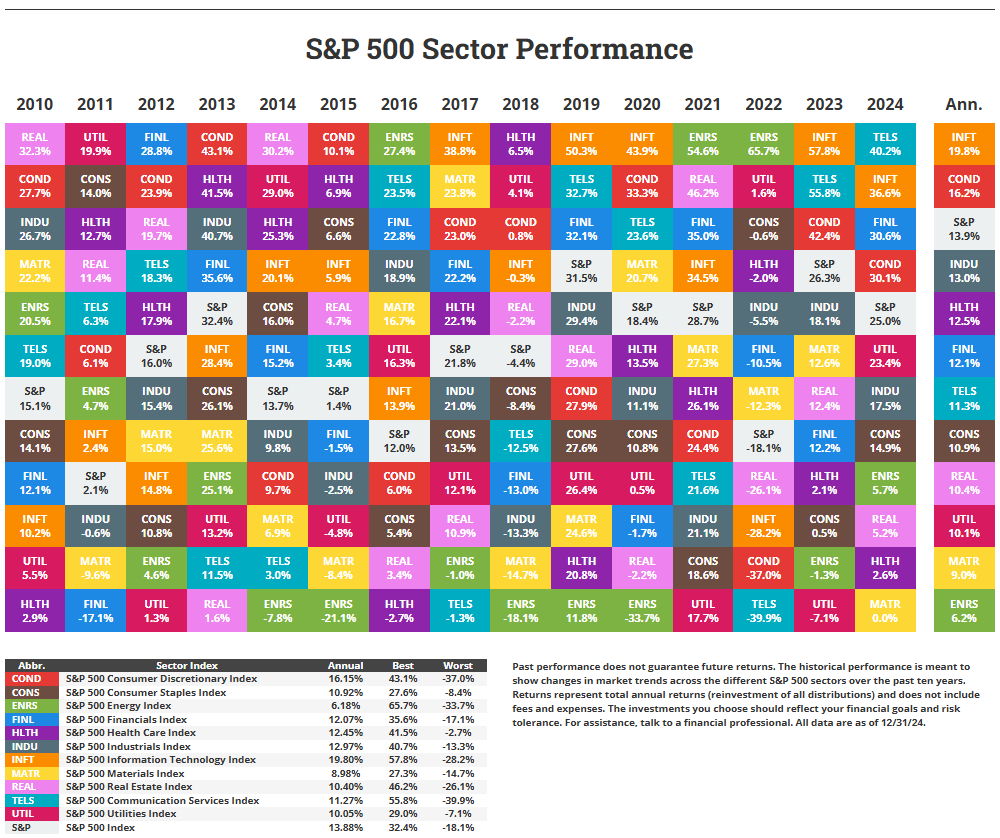

As you think about the performance of Fund A vs Fund B across any length of time, you can often explain much of their relative performance simply by the underlying sectors the 2 Funds have exposure to via their investment in individual stocks within those sectors.

To illustrate this point - see the chart below obtained from Novel Investor. Since 2010, the Technology sector has averaged ~20% annualized returns, whereas the Energy sector has averaged ~6% annualized returns.

If we take a fund like "VGT" (Vanguard Information Tech ETF) and compare its performance to a fund like "VDE" (Vanguard Energy ETF), it's not that the fund managers of VGT were somehow exceptionally better than VDE (the fund managers' role of VDE was not to outperform VGT), but rather, technology has had an incredible run since 2008, in large part thanks to macro-economic factors (such as fiscal policy and monetary policy) that were well outside the control of the technology companies within the fund VGT.

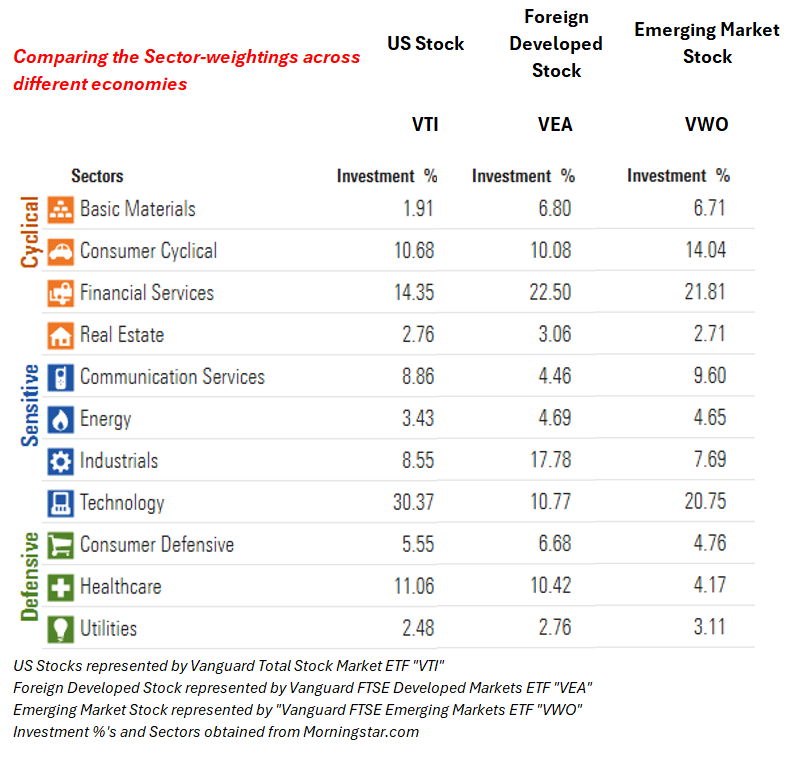

Now having set the stage, the US stock market as a whole has different sector-weightings than International Stock markets. This is because the US economy is more of a Services based economy (i.e. Technology, Healthcare), and International economies tend to be more Product based economies (i.e. Materials, Industrials). This is why solely using valuation metrics such as Price-to-Earnings ("PE") Ratios are not totally fair comparisons when looking at US stocks versus International Stocks by the way.

Given the US economy's tilt towards Service-based businesses, the underlying Sector exposure of only owning US stock funds will potentially subject you to overconcentration in sectors such as Technology - whereas adding in International stocks will diversify this Sector exposure, and reduce potential concentration risk in any 1 particular sector. See the visual below that compares the sector weightings of a US Total Stock Fund, Foreign Developed Total Stock Fund, and Emerging Market Total Stock Fund for reference.

What Percentage of International Stocks Should I Hold?

This is one of the many "allocation decisions" you need to make when constructing an investment portfolio. Some factors to consider include your personal goals for your investment portfolio, risk-capacity, risk-tolerance, behavioral tendencies, tax-allocation, desire for tax-efficiency, fee sensitivity, availability of investment fund options, home-currency, and appetite for diversification.

However, let me offer some recurring themes and data points not already discussed above:

Home Country Bias: As a US investor, you are likely familiar with many more US based companies than you are international based companies. And while I'm a believer in first becoming aware of biases we are predisposed to (you can't change what you first aren't aware of), I do think there's a level of importance in remaining engaged with your investment portfolio. And odds are the more you can relate to the companies you own and "invest in what you know", the more engaged you will likely be, which I think is something that's underappreciated today.

Tax-Allocation and Asset Location: As a general rule of thumb, US-dividend income is taxed more favorably to US investors than International-stock dividend income, so your existing tax-allocation (what tax-types of accounts you own; Roth, Pre-tax, or After-Tax) will matter, as well as which account(s) you choose to put your International Stock exposure in ("Asset location") for optimal tax-efficiency.

Metrics: For those seeking a globally diversified portfolio, here are some metrics for you to potentially ponder:

-Gross Domestic Product ("GDP") %: The US economy produces approximately 26% of the global GDP as of 12/31/2023.

-Investable Global Market: Of course, not all markets across all economies are able to publicly invested in, so when factoring in the portion of the global market cap that is able to be invested in, the US comprises ~45% as of 12/31/2023.

-Indexed Investible Global Market: Certain indexes, such as the FTSE Global All Cap Index leverages certain criteria and thresholds, such as meeting minimum size, liquidity, trading volume, and free-float (freely tradeable shares to the public) requirements. Under this index's methodology, the current U.S. exposure sits at ~64% as of the time of this writing.

Concluding Remarks

One of the investment principles at True Riches is "invest in preparedness, not prediction". Is now the time when international stocks will begin a run of outperformance relative to US stocks? While it can be tempting to want to predict, investors are making decisions [subject to a lot of feelings by the way] with incomplete information about what every new event means for an unknown future. At True Riches, we view the risk of prediction, and accordingly, whipsawing the portfolio back and forth all while incurring trading costs and potential taxes as RISKIER than maintaining a tax-efficient, headwind-light, globally diversified allocation that hedges various risks such as Market Risk, Individual Business Risk, Currency Risk, Political Risk, Concentration Risk, etc.

Portfolio construction and monitoring (the process of deriving a starting and ongoing investment allocation) involves many factors, and we believe each investor deserves a custom allocation tailored first to their risk-capacity (derived from their specific financial goals, household cash-flows, and time horizon) and secondarily to their risk-tolerance (feelings around risk and market volatility). We believe strongly in this order (risk capacity before risk tolerance) as risk-capacity lends itself to more customized, objective, unbiased portfolio construction decisions, but we also believe a Plan is only as good as what can be behaviorally adhered to, which is why we also believe layering in Risk-Tolerance as a secondary measure provides the best chance at accomplishing this objective.

Our investment approach is grounded in the intersection of behaviorally-optimized portfolios and Nobel Prize-winning research in financial science. If you would like to explore how True Riches could help you with efficient, ongoing portfolio management completed customized to your household Life Plan, take the first step by scheduling a complimentary, 60-minute discovery meeting below!

Schedule Your Complimentary 60-Minute Discovery Meeting

DISCLAIMER: This writing in its entirety is intended to serve solely as general financial education and not personalized advice. Before considering acting on anything in this post, first consult with your tax, legal or investment advisor.