The Sweet Income Spot for Health Savings Accounts – Moving from a Triple-Tax Benefit to a Quadruple Tax Benefit

In our first post “What is a Health Savings Account”, we uncovered what an HSA is, how to qualify for one, contribution limits, and what they can be used for.

Today’s post is all about the powerful tax-effects HSA’s can provide, and more specifically, we’ll explore if there’s a ‘sweet income spot’ for maximizing the tax-benefits of HSA’s.

HSA’s are often touted as a “triple-tax advantaged” account, meaning you pay no federal or state income taxes on contributions into an HSA (#1)*, no tax on the growth within an HSA (#2), and no income tax on the way out of an HSA as long as funds were used for a Qualified Medical Expense (#3).

*New Jersey and California do not give you a state income tax deduction for HSA contributions

The 4th Tax Benefit of HSA's

But there is a potential 4th tax benefit – avoidance of Social Security and Medicare taxes, otherwise known as payroll taxes. In order to dodge paying payroll taxes, you must be contributing to an HSA through your employer, and your employer must have the HSA set up through a Section 125 Cafeteria Plan (most do, but it’s best to confirm with HR).

The other factor on how effective dodging payroll taxes will be is YOUR specific level of earned income.

The Medicare tax rate is 1.45% on your first $250k [$200k] in earned wages for Married [Single] persons, then 2.35% for anything above $250k [$200k] for Married [Single] persons. There is NO CAP on Medicare taxes.

Social Security taxes, however, have a cap! The Social Security tax rate is 6.2%, but only applies on the first $168,600 in wages in 2024 (gets adjusted annually for wage inflation). So if you make over $168,600, contributing to an HSA won’t allow you to dodge Social Security taxes, just Medicare taxes. This doesn’t mean you should or shouldn’t contribute to an HSA, it just means you don’t have the ability to dodge the Social Security tax component.

The Sweet Income Spot for HSA's If You Make Under $168,600

In order to be eligible for the Quadruple Tax Benefit, you have to earn under $168,600. But is avoiding Social Security tax a good thing? After all, some view the 6.2% Social Security Tax as beneficial because it’s a form of forced savings – because the tax you pay now into Social Security determines your Social Security benefit amount once you’re at least 62 years old.*

*If you believe Social Security will be gone or won’t apply to you when you’re over Age 62, you can simply move on and feel great about dodging the 6.2% tax assuming you make under $168,600. For readers who think Social Security may still be around in some form (like me), there’s 1 more caveat to uncover below.

As few are likely aware, every dollar you earn (and accordingly, pay into the Social Security taxation system) does not count evenly when it comes to determining your Social Security benefit. It’s a tiered system where the benefit to your Social Security benefit amount gets smaller and smaller the more you earn.

In 2024, the first $14,088 you earn get’s a 90% “crediting rate” towards your Social Security Benefit. The next $70,848 of your earnings ‘only’ gets you a 32% crediting rate towards your Social Security benefit. And finally, any earnings above $84,936 (up to the $168,600 cap) merely get you a 15% crediting rate!

As such, the most power in dodging Social Security taxes exists between earning $84,936 and $168,600!

The Bigger Picture

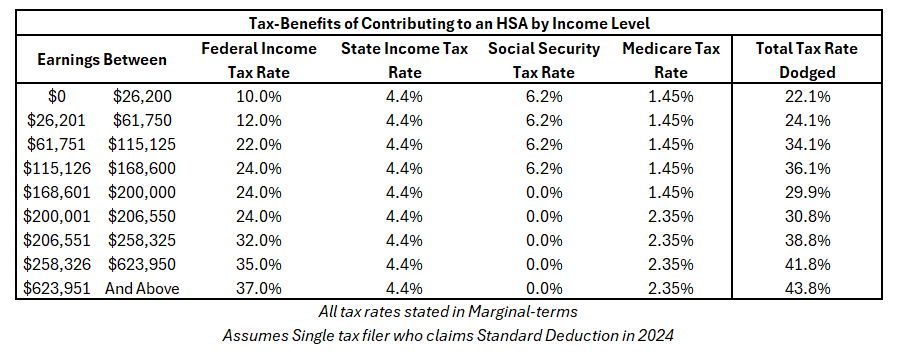

On the flip side, given we have a tiered Federal Tax System (i.e. tax rates get higher and higher the more you earn), just because you get all 4 tax-advantages of HSA’s doesn’t always mean it will provide greater tax benefits than if you only get 3 of the tax advantages, because each tax advantage comes with different weightings. All factors of taxation - among other things such as cash-flow, existing makeup of net worth, income earned by each spouse for married couples, other health coverage such as an FSA, etc.) must be considered to determine if an HSA is right for you. Most financial decisions have to be looked at from multiple angles in order to assess their true viability and prudence. Nonetheless, the taxation factors are included below for various levels of earnings, with the Total Tax Rate Dodged in the outermost right column for each level of earnings.

Interestingly, the tax-benefits of an HSA experience a dip between earnings of $168,600 and $206,551, an individual person earning ~$115k yields greater tax benefits than somebody who earns ~$206k, and the ultimate sweet spot falls between $115,126 and $168,600!

Keep in mind the above scenarios are for a Single taxpayer. The equation gets even more complex once you throw in a dual-income Married Couple, as Social Security taxes are only based on earnings from each individual-taxpayer (by Social Security number), and the payroll tax savings only apply to the person with the High-Deductible Health Plan (“HDHP”) in the first place. In other words, a married couple where each spouse earns >$84.3k (half of the wages where the Social Security tax ends) and each has their own individual, self-only HDHP will result in different payroll tax savings than if 1 spouse covers both of them through Family HDHP insurance coverage.

Married couples or families also make it more interesting because unlike Social Security taxes (which are at the INDIVIDUAL TAXPAYER level), Federal & State Income taxes are based on collective HOUSEHOLD income (and Medicare tax is somewhat of a hybrid). The opportunities and complexities open up even further once you have kids, especially if both spouses have HDHP’s available through their respective employers and at different level of premiums.

Do Self-Employed Solopreneurs get tax benefits for contributing to an HSA the same as Employees at large companies? Do they also reap the quadruple tax benefits?

Deciding whether an HSA makes sense for you or your family requires an ability to look at a myriad of financial factors – some tangible and some intangible as well. If you are curious in exploring the value of a Household CFO and how to approach informing decisions such as an HSA, book a complimentary 45-minute Discovery Call today!