A few years ago, I attended a Journey of Generosity retreat hosted by some close friends. For a Friday night and Saturday morning, those of us at the retreat talked about what it looked like to lead generous lives (with the help of some amazing discussion resources from an organization called Generous Giving). It was eye-opening to say the least, and I've thought about generosity more these past few months than any other time in my life.

After that retreat, I received a book from Generous Giving titled "True Riches: What Jesus Really Said About Money And Your Heart". This book presented one of the most concise, logical, and applicable frameworks I have seen on handling money, and I felt inspired to share a brief outline on this blog in hopes of it provoking contemplative thought for you around what generosity in your life looks like. In this post, I will point out where I think we've gone wrong at multiple points. Emphasis on we (INCLUDING ME!). My intent is to be authentic, real, and to bring people closer towards a life of greater generosity. Please have my intent in mind as you read this.

While the framework is qualitative in nature, my prayer is that you can take this framework to the Lord and ask Him how to apply it to your personal finances.

Framework for Handling Money:

(1) We move from Pride to Gratitude and therefore, we See Everything As a Gift

(2) We move from Coveting to Contentment and therefore, we Spend Modestly

(3) We move from Anxiety to Trust and therefore, we Save Modestly

(4) We move from Indifference to Love and therefore, we Give Extravagantly

This book is only 134 pages in length (with generous line spacing and text size, and not to mention optional application-based worksheets at the end of each chapter), so I won't go into each of 4 aspects of the framework individually, but rather, provide a high level overview of the thoughts that went on in my mind as I was reading the book. My hope is that you can order yourself a copy, and enjoy the entire book in about 3-4 hours.

The Coveting Problem:

Living in America (or any developed nation for that matter), we have blind spots in our finances. We have so much more than we could ever NEED, and yet, we are constantly striving for more. Said another way, we lack contentment. Why else would there be over $1.5 trillion in auto loans, and almost $1 trillion in credit card debt in the U.S. alone? And why are we blind to it? Because it's normalized. Especially in the church world, where we have de-stigmatized certain types of sin (primarily coveting and accordingly, idolatry). Could you imagine someone talking about their infidelity in the church lobby? I highly doubt it. But do we even blink when someone is publicly talking about their new $70,000 car, or $40,000 bathroom remodel, or $1,100 cell phone? While I understand many of us are beyond fortunate to have the means to purchase these things, they are flat out stealing our ability to be generous.

In a large survey of Christian Millennials, 70% claimed to be generous with their money, but only 16% gave more than $50 to a church or charity in the prior year. If that isn't blind, I'm not sure what is.

Giving among American Protestants has continued to decline through the decades, even as they've seen their wealth vastly increase. A study determined that in 1968, giving averaged 3%, down to 2.5% in 2005, and down even further to 2.2% in 2016. Less than 3 percent of American's give away at least 10% of their income on an annual basis. Need I say again, we have a coveting problem, which is stealing from our ability to be generous.

The F.I.R.E. (Financial Independence Retire Early) Movement:

It's weird for me to say this as a personal financial planner but saving is stealing from our ability to be generous. Now I'm not talking about thoughtful, modest saving. I'm talking about saving at the expense of not giving. While this goes hand in hand with the coveting problem (we save more for ourselves so our future selves can continue to covet after we've stopped working), this book revealed that sneaky destroyer called Anxiety. Anxiety that we won't have enough now or in the future -- a scarcity mindset driven by fear and what-If scenarios. "If I don't save every extra dollar I have right now, I'm not going to be able to retire by age 50 while maintaining my current lifestyle". This anxiety (or worry) drives us deeper and deeper into the idol called Comfort.

My own thoughts now:

a) The F.I.R.E. movement places greater value on our future comfort than current suffering.

b) The F.I.R.E. movement places greater value on financial independence than dependence on God.

Also not in the book, but I can't help but interject The Parable of the Rich Fool (Luke 12:13-21):

13 Someone in the crowd said to him, “Teacher, tell my brother to divide the inheritance with me.” 14 Jesus replied, “Man, who appointed me a judge or an arbiter between you?” 15 Then he said to them, “Watch out! Be on your guard against all kinds of greed; life does not consist in an abundance of possessions.” 16 And he told them this parable: “The ground of a certain rich man yielded an abundant harvest. 17 He thought to himself, ‘What shall I do? I have no place to store my crops.’ 18 “Then he said, ‘This is what I’ll do. I will tear down my barns and build bigger ones, and there I will store my surplus grain. 19 And I’ll say to myself, “You have plenty of grain laid up for many years. Take life easy; eat, drink and be merry.”’ 20 “But God said to him, ‘You fool! This very night your life will be demanded from you. Then who will get what you have prepared for yourself?’ 21 “This is how it will be with whoever stores up things for themselves but is not rich toward God.”

If I were writing The Message version on verse 21, I'd translate that as: "Those who save in high proportion at the detriment of giving are fools".

A framework for giving:

Of course, no statistics or logical reasoning will change someone's giving habits for the long haul. Only a changed heart will do that. But sometimes, you have to start giving before you feel like giving. And God will begin to change your heart through the process. The more organizations and people I've been able to give to, the more contagious it has become. That is design by purpose. God helps us move from Indifference to Love, and our innate desire becomes to give extravagantly.

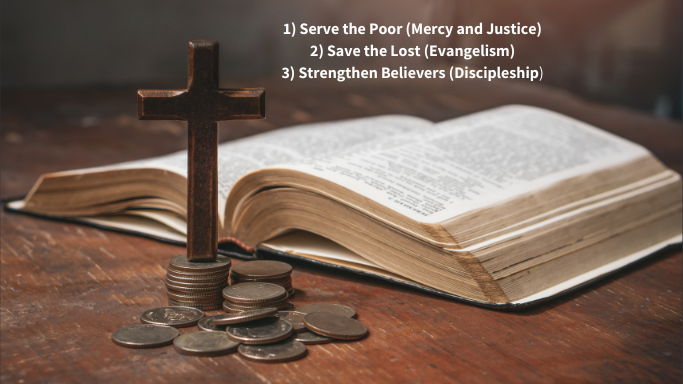

From a practical perspective though you may be asking yourself, "Where do I give to?". In the book, they offer a 3-pronged framework for identifying people and organizations to give to, as follows:

The book uses Scripture to back up this 3-pronged approach. What was super helpful for me though was looking at each of the people and/or organizations I give to, and evaluating which of the 3 aspects (does not have to be limited to 1) that organization's purpose fulfills. Does my giving hit all 3 purposes? Am I "overweight" heavily to one and "underweight" to another? Which of these 3 is my heart most inclined towards, and does my giving align with that?

The 1 dislike about the book:

As a personal financial planner, I have read a lot of books about money. None of them are perfect, this book included. I hold strongly that finances are personal. While I believe in frameworks that are universal, dollar amounts and percentages are not. With that, I think the book should have steered away from recommending specific recommendations and thresholds. The main one was not to take out a mortgage more than double your annual income. That means if your annual income is $250,000, you shouldn't have a mortgage exceeding $500,000. Another was to establish an emergency fund of $2,000. I'm not against emergency funds, but to say that all households should have the same dollar value emergency fund makes me frustrated. And finally, to "pay off all debts except for an affordable mortgage". In most instances this is a good strategy, but is not a universal truth to sound financial planning.

The underlying purpose of this book in my eyes was to present a biblical qualitative framework for handling money. It accomplished that and more in my eyes. So if you do decide to read and engage with this book (which I highly suggest you do!), just forget about the quantitative 'recommendations' that are probably less than 2% of the entire book :)

What Truly Matters:

"Success" with money is more about our heart posture than anything else. While there are many nuances and good technical planning strategies available, I think God cares most about our heart. After all, "for where your treasure is, there your heart will be also" (Luke 12:34). Need some more evidence? Check out these resources all without having to leave the book of Luke in your Bible:

The Good Samaritan (Luke 10:25-37)

The Rich Man and Lazarus (Luke 16:19-31)

The Shrewd Manager (Luke 16:1-15, notice verses 10 and 11)

The Rich Young Ruler (Luke 18:18-30, notice verse 22)

The Widow's Mite (Luke 21:1-4) -- we are the rich people in that story by the way.

The Lord's Prayer (Luke 11:1-4, notice verse 3)

A Challenge:

Join me in weaving the below prayer from Agur into your daily walk with God; emphasis on verse 8 to provide for our DAILY NEEDS, just like Jesus asked in the Lord's prayer.

Proverbs 30:7-9:

“Two things I ask of you, Lord;

do not refuse me before I die:

8 Keep falsehood and lies far from me;

give me neither poverty nor riches,

but give me only my daily bread.

9 Otherwise, I may have too much and disown you

and say, ‘Who is the Lord?’

Or I may become poor and steal,

and so dishonor the name of my God.